179 depreciation calculator

Assets are depreciated for their entire life allowing printing of past current and. So your first-year deduction on the 45000 SUV purchase is 35000.

Tax Calculator Section 179 Ellison Technologies

The list of vehicles that can get a Section 179 Tax Write-Off include.

. Qualified tangible personal property. Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000.

Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available. The you dont receive any further depreciation deduction.

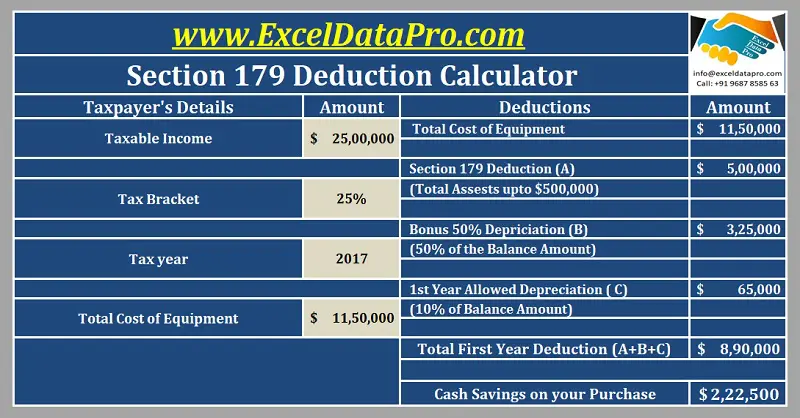

The Car Depreciation Calculator uses the following formulae. In other words all section 179 deductions for all business property for a year cant be greater than 1 million. Free MACRS depreciation calculator with schedules.

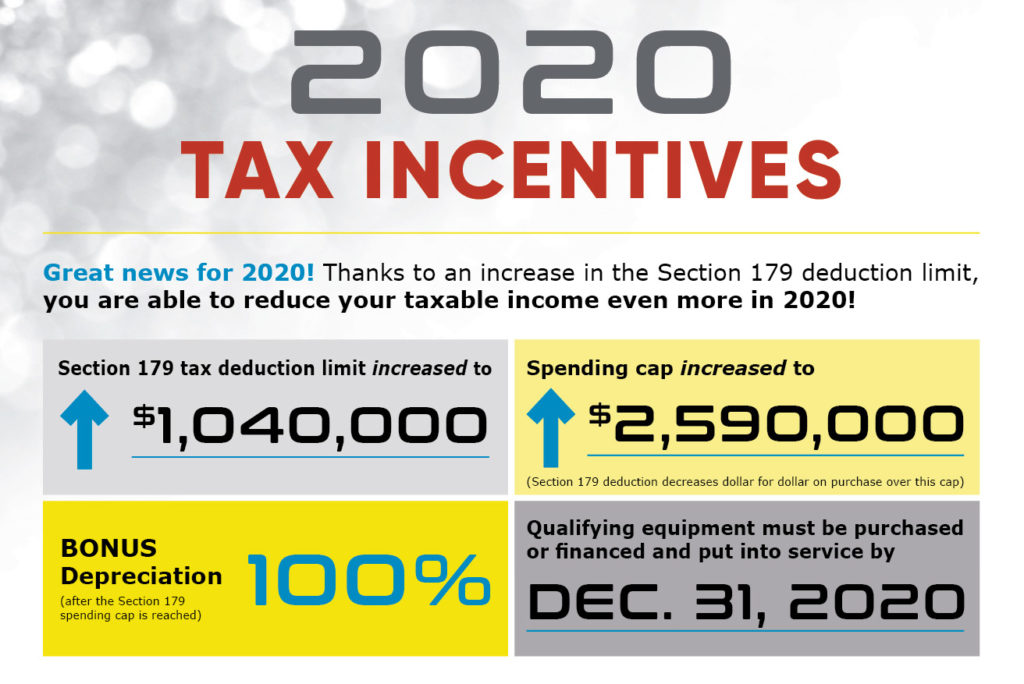

MACRS declining balance changes to straight-line method when that method provides an equal or greater deduction. The total amount you can take as section 179 deductions for most property including vehicles placed in service in a specific year cant be more than 1 million. What Vehicles Qualify for the Section 179 Deduction in 2022.

For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently.

The dollar amount is adjusted each year for inflation. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. And then use the section 179 exclusion.

Under Section 179 you can write-off 100 of the purchase price of the equipment you finance up to the yearly deduction limit. A P 1 - R100 n. Adheres to IRS Pub.

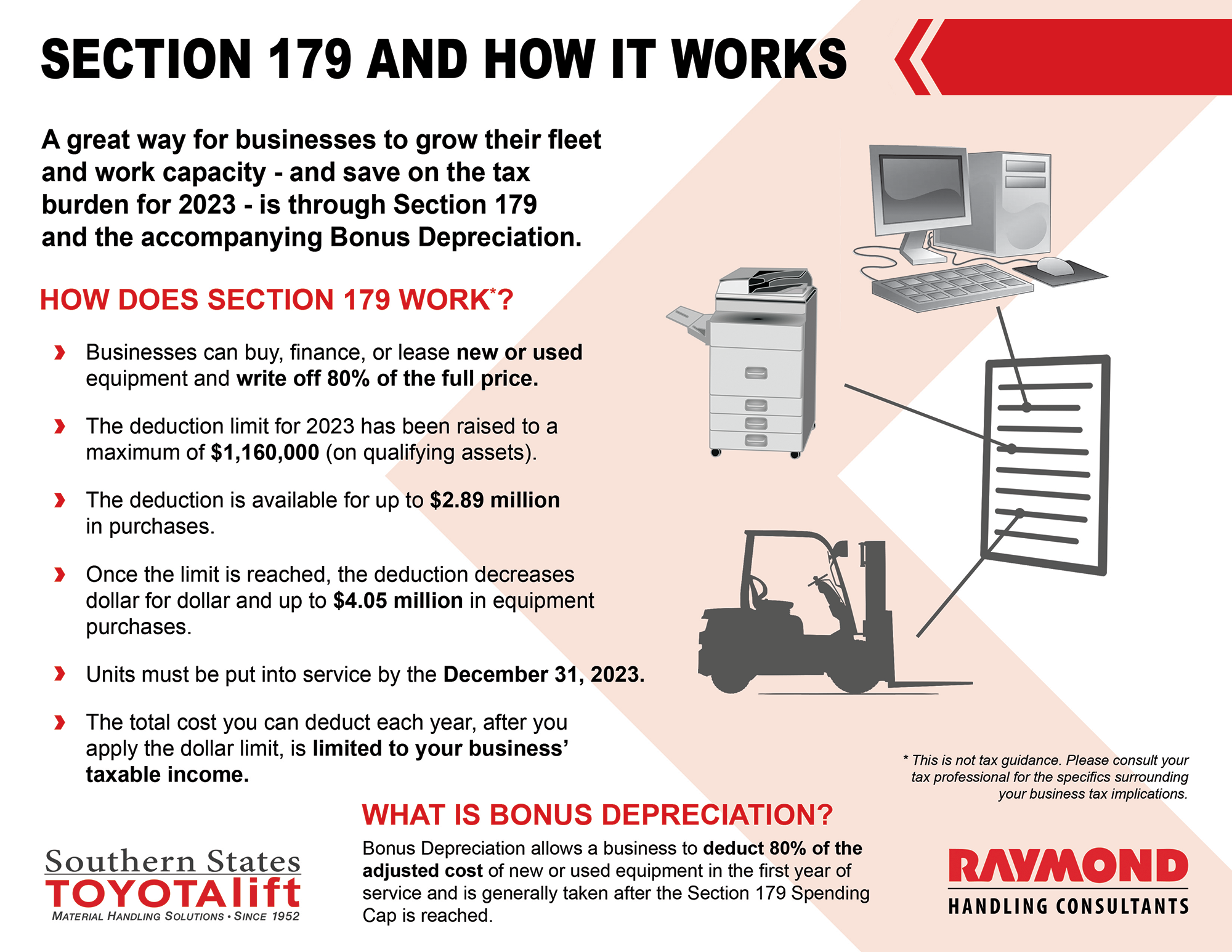

Purchases of business equipment office furniture computers software and technology as well as many other business assets qualify for Section 179. D P - A. Youd do this by deducting all or a portion of the cost of certain property as opposed to depreciating it.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Depreciation limits on business vehicles. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

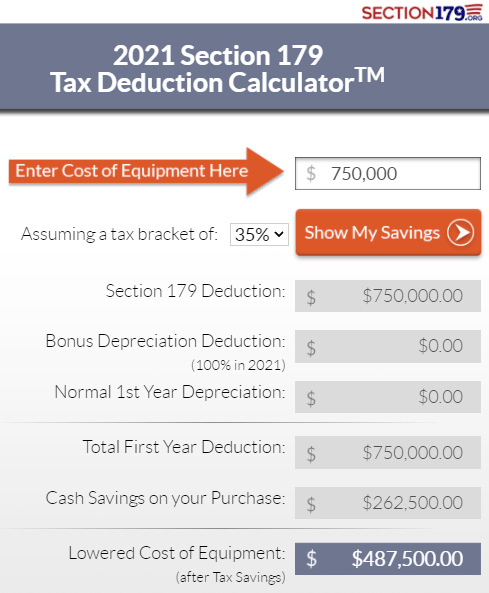

Plain-English information on deducting the full cost of new or used qualifying equipment software and vehicles purchased or financed. Heres an easy to use calculator that will help you estimate your tax savings. Read more about these strategies.

Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs. If you purchase equipment over the deduction limit of 1080000 you may qualify for bonus depreciation. So for a vehicle if you claim section 179 and Bonus depreciation on a vehicle the 1st year.

Updated Section 179 for 2022 Deduction information plus bonus depreciation. Depreciation for 2009 using Table A-1 is 100 million 20 20 millionDepreciation in 2010 100 million - 20 million 15 200 32 millionDepreciation in 2010 using Table 100 million 32 32 million. Please note that this Section 179 Calculator fully reflects the current Section 179 limits and any and all amendments bonus depreciation.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. A regular depreciation percentage applies sometimes but only a tax professional can confirm this. What types of purchases qualify for Section 179.

The average car depreciation rate is 14. You can claim the Section 179 deduction when you placed these types of property into service during the tax year. Businesses often miss great tax-saving opportunities because they arent aware certain tax breaks exist.

Or you can use a 1031 exchange to defer depreciation recapture taxes. When you buy an asset like a. Under Section 179 you can claim a deduction in the current year.

After Section 179 deductions are taken by a small business bonus depreciation may be applied to further accelerate depreciation. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction.

The Current State Of The Section 179 Tax Deduction

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Sz1znxdfmlybgm

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Explore The Hidden Tax Advantage With O Connor Case Study Income Tax Commercial Property

Bellamy Strickland Commercial Truck Section 179 Deduction

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

Free Section 179 Deduction Calculator For Us Internal Revenue Code

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

Section 179 Deduction Hondru Ford Of Manheim

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Section 179 Tax Deduction Gt Mid Atlantic

Section 179 Irs Tax Deduction Updated For 2022

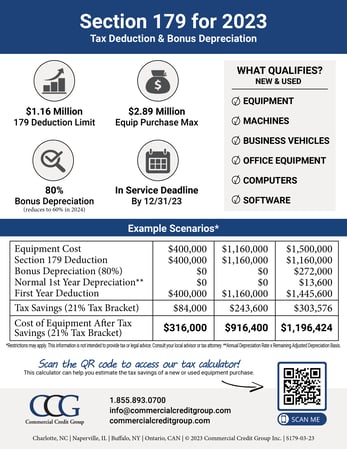

Section 179 Calculator Ccg